When Identity Theft Happens To You

Let’s face it, we’ve all had our moments where we close our eyes and wish our lives upon someone else. Maybe not every day, or even every month, but we’ve all hit that wall, where forcing someone else into our shoes (low budget Payless brand shoes that they are) seems all too appealing. Someone else to tackle our insurmountable mountain of bills. Someone else to sub in for our never-ending “who gets paid now and who has the lowest late fee” game. Someone else to worry about rent, car payments, electric, student loans, credit scores, and the possibility of EVER seeing a light at the end of the financial tunnel. Most of the time, those thoughts are fleeting. We wake up and remember that everyone is fighting that same battle and we move on with our day. But for 16.6 million Americans a year, those thoughts become reality, and the end result is far from what we dreamed.

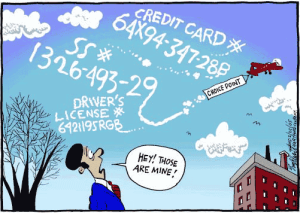

According to recent studies, identity theft has become the most frequent and costly crime now committed in the United States. At any given time, 100 million Americans and their personal information are at risk. And while many blame the internet and the carelessness of its users for this growing problem, the fact is, the majority of identity theft comes from the vulnerable security databases within large corporations. My information was taken from such a corporation. And while for a brief moment when I found out about it I thought maybe I wouldn’t have to keep paying my student loans, turns out that’s not how the bad guys operate.

According to recent studies, identity theft has become the most frequent and costly crime now committed in the United States. At any given time, 100 million Americans and their personal information are at risk. And while many blame the internet and the carelessness of its users for this growing problem, the fact is, the majority of identity theft comes from the vulnerable security databases within large corporations. My information was taken from such a corporation. And while for a brief moment when I found out about it I thought maybe I wouldn’t have to keep paying my student loans, turns out that’s not how the bad guys operate.

Throughout the process of putting my identity back together and proving to the government that I really am who I say I am, I’ve learned five really important things that I wish I had known going into all this:

1) Do not ever call the IRS. They will yell at you. And by yell at you, I mean you will get halfway through your first question before they interrogate you about whether or not you read the form, if you have any idea how busy they are, and then proceed to yell at you about how protecting your identity is your responsibility. Oh, and when you ask if they can transfer you to someone with a little less condescension and a little more understanding, they will tell you that they might have those people there but you will have to call back, and then they will hang up on you. When in doubt, follow all the directions on the form whether clear or not, and just mail everything you have to them and let them sort it out.

1) Do not ever call the IRS. They will yell at you. And by yell at you, I mean you will get halfway through your first question before they interrogate you about whether or not you read the form, if you have any idea how busy they are, and then proceed to yell at you about how protecting your identity is your responsibility. Oh, and when you ask if they can transfer you to someone with a little less condescension and a little more understanding, they will tell you that they might have those people there but you will have to call back, and then they will hang up on you. When in doubt, follow all the directions on the form whether clear or not, and just mail everything you have to them and let them sort it out.

2) Put a fraud alert on your credit immediately. It literally takes about 6 minutes. Call one and the alert is automatically transferred to all three. It’s all an automated process, so no cranky call center reps (see item 1) to give you lectures.

3) Get your free credit reports and go over them with a fine tooth comb. You get one free credit report per year with each credit bureau, this is the time to use them! Be sure to look through each one for accounts opened or reactivated that you didn’t authorize. You can also check to see if your credit has been checked by financial institutions in conjunction with a loan or credit application. If it has, and you’re not buying a mansion in the Cayman’s, call them immediately.

4) Save the FTC for last. You will want to file a report with the FTC, but all of the information they want from you are things you will find out by working with the IRS and credit bureaus. Why this step is always listed as #2 I do not understand.

5) Shout it from the rooftops! Seriously, this is one time where ranting and raving on Facebook is allowed and even a good thing. I never knew so many people were dealing with the same thing until I put my troubles out there. If your venting helps a friend become a little more guarded, you owe it to them to let it all out.

At the end of the day, no one should have to fight to prove who they are or to rightfully claim what is theirs. Unfortunately, that’s not the world we live in, but we can have each other’s backs in the meantime.